What is GMX Crypto?

GMX is a decentralized perpetual exchange that allows users to trade with up to 30x leverage in many popular crypto assets such as BTC, ETH, AVAX, and many more tokens! Best of all you can trade directly from your wallet without restrictions or KYC!

Welcome to $GMX the leader in distributing 100% of protocol fees back to token holders!

GMX is a decentralized perpetual exchange on the Arbitrum and Avalanche blockchain. $GMX allows users to trade with up to 30x leverage, 24 hours a day, 7 days a week! The assets listed below can be traded directly from your wallet! Think of it similar to a Binance or FTX, but on the blockchain.

Related: How to buy GMX Crypto!

Benefits of using on-chain apps include:

- NO centralized authority.

- NO geographical restrictions.

- NO logins needed.

You can trade up to 30x in leverage in real time on your favorite coins listed below:

On Arbitrum:

- ETH

- BTC

- USDC

- USDT

- DAI

- LINK

- UNI

- FRAX

- MIM

On Avalanche:

- BTC

- AVAX

- ETH

- USDC

- USDC.e

- MIM

GMX is a decentralized exchange that supports low swap fees and zero price impact trades.

How do I earn?

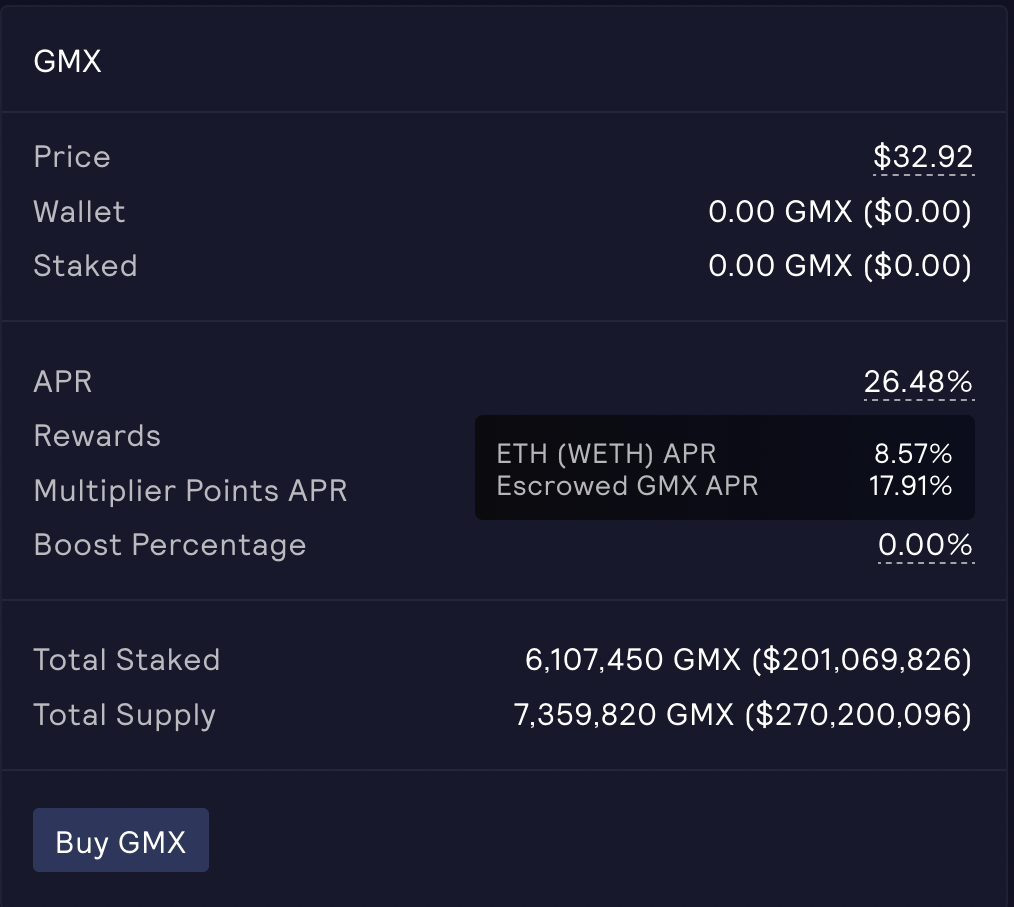

I’ve been earning Ethereum (WETH) passively for about 6 months now, and the interest rates have been hovering between 5%-16% paid every 15 seconds or every block to be technical. I also earn the native token in escrowed form esGMX. As you can see here:

esGMX stands for escrowed $GMX that's available to vest in 1 year or you can compound your earnings and earn even more Ethereum!

Now, if you are familiar with the other blockchains like $AVAX then you will be able to do the same on Avalanche, which is essentially a cheaper Ethereum similar to Arbitrum the layer 2!

Only difference is on Avalanche you earn $AVAX and $esGMX!

Related: How to Bridge to Arbitrum!

How does GMX earn fee’s?

GMX earns fees in many ways, for example when you buy or sell coins on GMX.io directly, users pay low swap fees similar to cryptocurrency exchanges.

They also earns liquidity providers fees and from asset rebalancing.

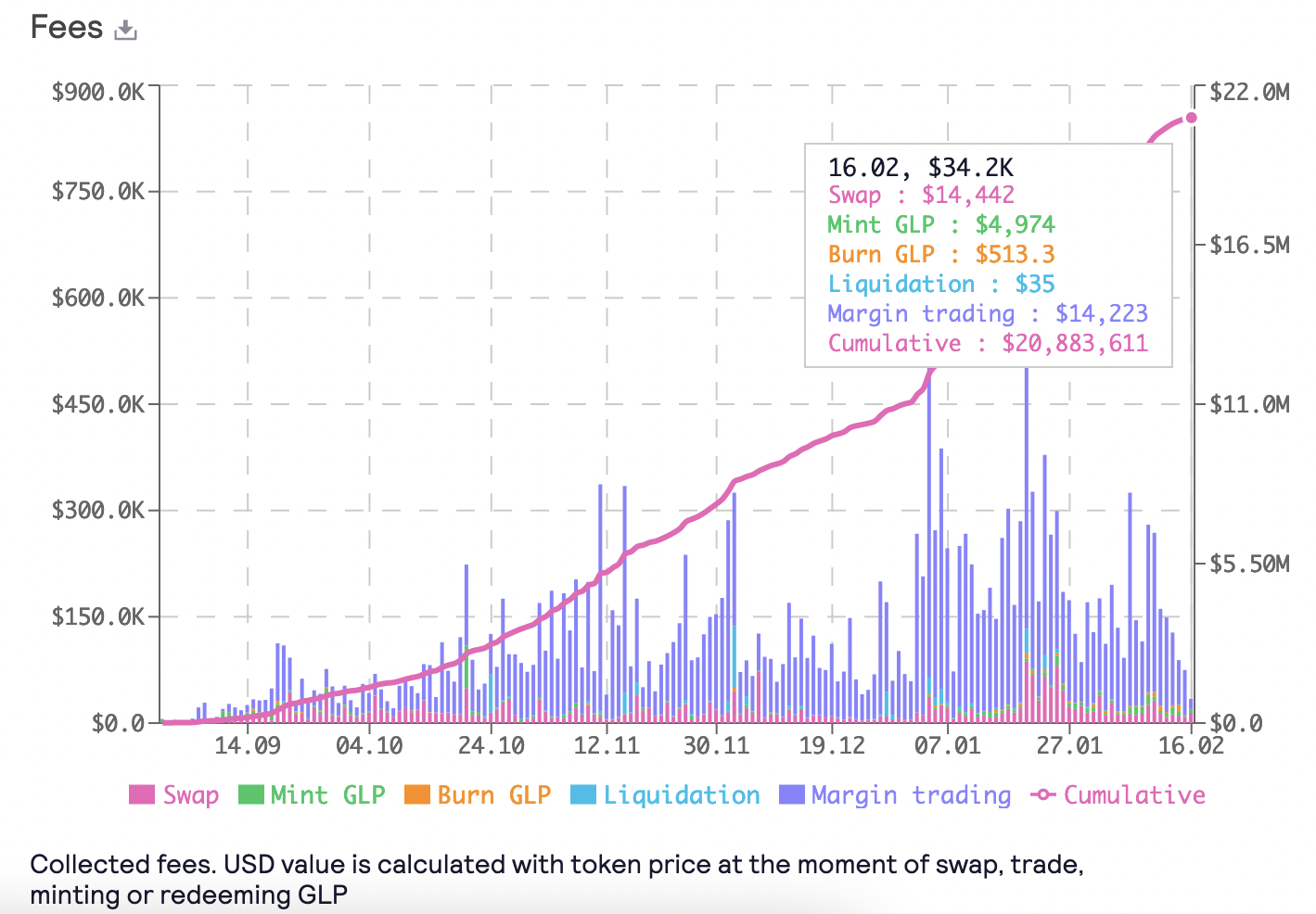

Another way the protocol earns fee’s are from swap fees traders make on the platform, minting the native liquidity token GLP and they have plans to integrate more revenue streams in the future! Here's a photo of their earned fees. Please note, this is only the fees earned on Arbitrum, and does not include the Avalanche fees.

On average they are doing about 1-2 million dollars in revenue per week, which all fees go directly to $GMX stakers and $GLP holders.

The current GMX price at the time of writing is at $32 USD with the highest price reaching $62 USD!

It's market cap is at about $230 million. Could we possibly see an all time high soon? It really depends on the price of GMX and the amount of volume & total fees collected.

GMX coin recently hit a milestone of $25m+ in total fee’s distributed, huge congrats to the team and community!

GLP

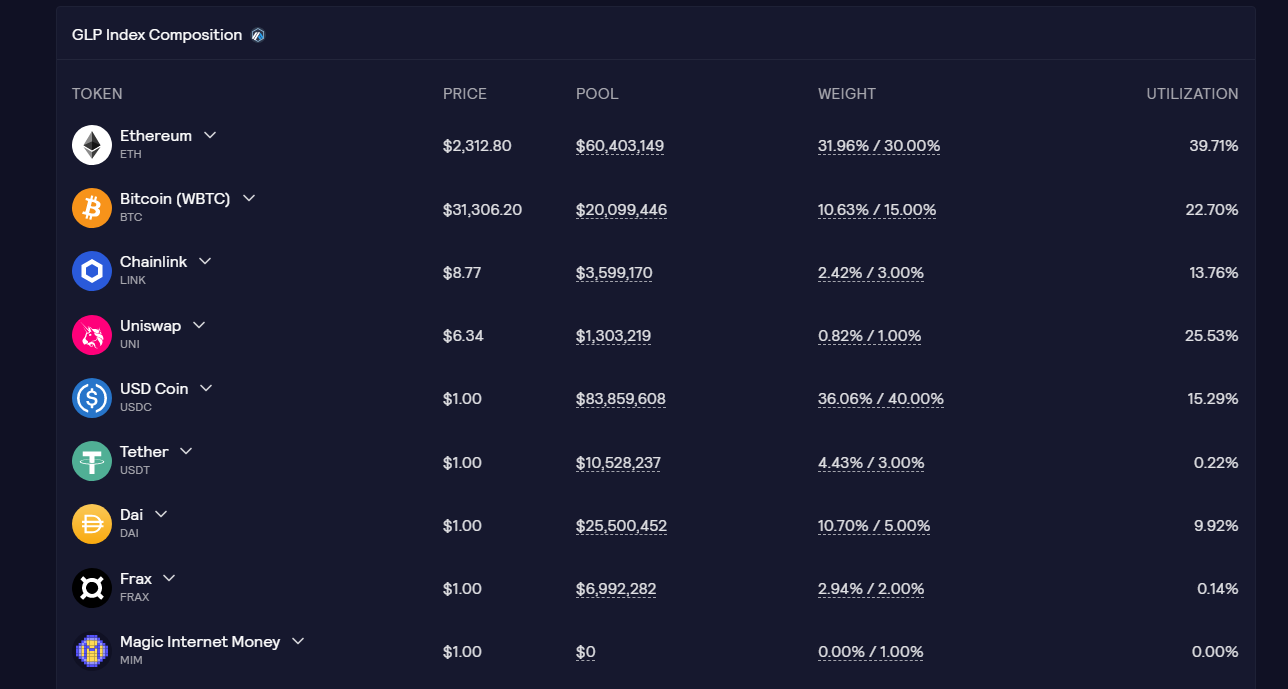

Another way of earning yield is through GLP which is providing liquidity for traders. GLP consists of an index of assets used for swaps and leverage trading. It can be minted using any index asset and burnt to redeem any coin.

The GLP AUM allow traders to long/short with up to 30x leverage on their favorite tokens, it also allows spot traders to trade with leverage on their favorite tokens with 0 price impact, both long term and spot investors can enjoy the accrual of fees leverage trading spreads make & earn liquidity provider fees.

The GLP APR is paid out in ETH, currently it's 26%. $5,000 invested in GLP will generate approximately $1,300 in ETH 12 months.

It should be mentioned that their are risks involved in owning GLP, such as if traders are winning, they are lowering the price of $GLP. So, it's not guaranteed and therefore, the reason why 70% of all fees are distributed to GLP holders.

Own Decentralized

You’re probably asking how is this different from Binance or FTX? Well, it’s the fee-sharing model.

With Binance and FTX, token holders earn no share of the fees the business generates.

GMX distributes 100% of all fees earned back to GMX stakers and GLP holders. The breakdown is 30% of fees to GMX stakers and 70% of fees to GLP holders, a truly unique multi asset pool!

Users choose which currencies they prefer to be paid in, either ETH or AVAX.

The amount received per GMX increases or decreases depending on the volume traded on the platform every week, fee data resets on the site every Wednesday.

Imagine if you could earn a cut of the decentralized derivatives daily fee’s which are averaging about $100 billon+ per day in volume? Well, GMX is looking to become the lead decentralized spot and perpetual exchange that supports low ETH gas fees on Arbitrum!

GMX team

The GMX team is professional, from the developer’s to community member’s they all are very helpful. The lead dev X is also very communicative and is constantly looking at ways to improve the platform. Personally, the team is one of the best I’ve ever communicated with, in addition they are constantly shipping, such as the recent Avalanche launch which only strengthens the platform and increases revenue!

Blueberry Club:

The Blueberry club is an innovative NFT project that was produced by community members that rewards holders with a monthly airdrop of esGMX depending on how much GMX they have staked. They receive escrowed GMX that can be staked for more rewards!

Honestly, I have yet to see NFT projects reward holders that are also interested in the platform, but GMX is once again innovating.

I’m very excited to see how this project will play out and possibly influence the future of NFT’s. You can find more information about the Blueberry Club here!

Final Thoughts:

I personally like $GMX and will continue to stake with them. The key metric I'm interested in is growth in trading volume.

As always make sure to do your own research before investing in alt coins!

I will continue to monitor GMX and it's path to becoming one of the leading volumes DEXs.

Follow me on Twitter to stay up to date!

-M

Disclosure: None of this is financial advice, please with an investment manager before investing in Crypto.